Raising More from Less: Five Strategies for Fundraising in 2025

There’s no doubt that it’s been a turbulent year for the economy. Every month, there’s a new high-stakes subject to talk about: tariffs, inflation, stalled job growth, the stock market, interest rates, and the government shutdown, along with what’s going to happen once the “One Big Beautiful Bill Act” takes full effect. But in our field, someone is always asking: What does that mean for fundraising?

It’s easy to get lost in different data points, so a fallback I use is trying to gauge what is going on in the minds of donors.

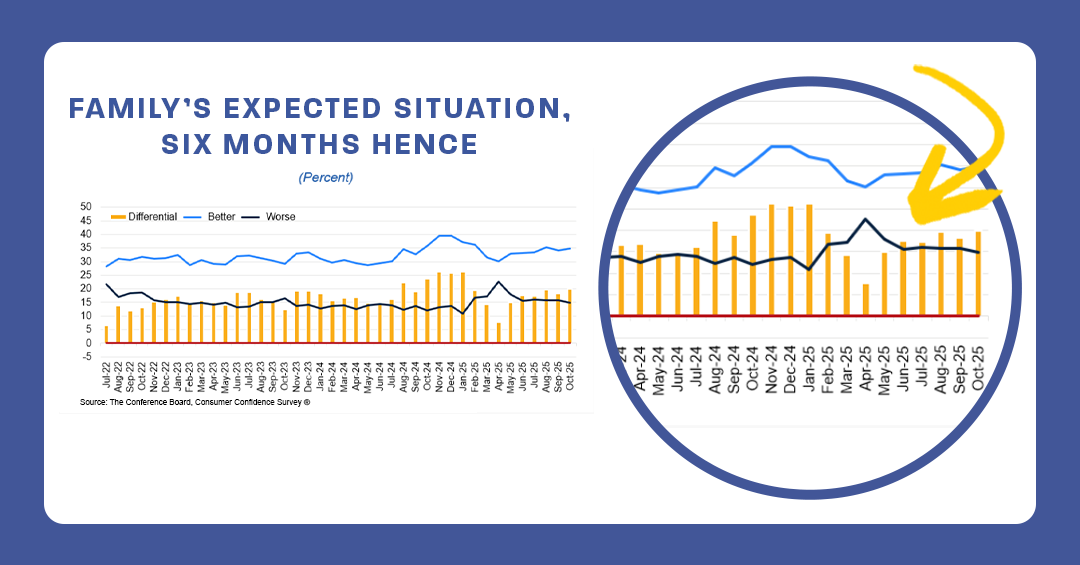

The Conference Board shares each month how consumers assess their “Family’s Expected Financial Situation, Six Months Hence.” From January to April, there were declines in the number of people expecting their situation to get better and increasing levels of people expecting their situation to get worse. In May the assessments began strengthening, and in September we see that they’ve “cooled slightly,” in The Conference Board’s words. October sees some improvement.

Looking at the big picture with our fundraising glasses on, the year started with an increasing number of people expecting their financial situation to get worse and a decreasing number of people thinking their situation would improve. That’s a recipe for more donors tightening their budgets and scaling back giving. This shrinks the active pool of donors – or, in some cases, donors simply chose to give less.

Accordingly, some of our programs in the beginning of the year saw fluctuations in response rates and/or average gifts, especially in donor segments that are more susceptible to market trends. As we traced our own monthly metrics across digital channels in Nonprofit Trends by MissionWired, we saw a spring dip (YTD revenue was down 16.63% in April), but that improved along with consumer expectations, and July saw year YTD revenue was up 9.88%. At the end of August, it was still up 9.45%, but as September’s financial expectations saw cooling, this revenue eased a little and was up just 4.66%.

Results vary from one vertical to the next as organizations responded to emergencies, funding cuts, and breaking news within the scope of their mission. However, a key trend we see is that while revenue is up, total gifts are down 6.32%. This underscores the narrative that nonprofits are trying to get more from less, and MissionWired isn’t alone in showing this challenge.

Earlier this year, The Fundraising Effectiveness Project released their Q1 benchmarks with the headline “Fundraising Effectiveness Project Data for Q1 2025 Shows Increases in Dollars Raised, but Declining Numbers of Donors.” It showed total donors were down 1.3%, but total dollars were up 3.6% year over year. The Q2 benchmarks released at the end of October show donors down 1.9% while dollars are up 2.9%.

Under the surface of the topline numbers, the Q2 report calls out that “Micro donors ($1 – $100), who make up 51.9% of the donor base, show the biggest relative drop (-10.4% YOY, unadjusted for late data) in donor numbers, with the other size categories seeing more modest decreases.” It also states, “The rate of decline in donor counts was smaller among larger donor groups, mirroring trends seen in past quarters.”

What is happening to create more revenue coming from fewer donors?

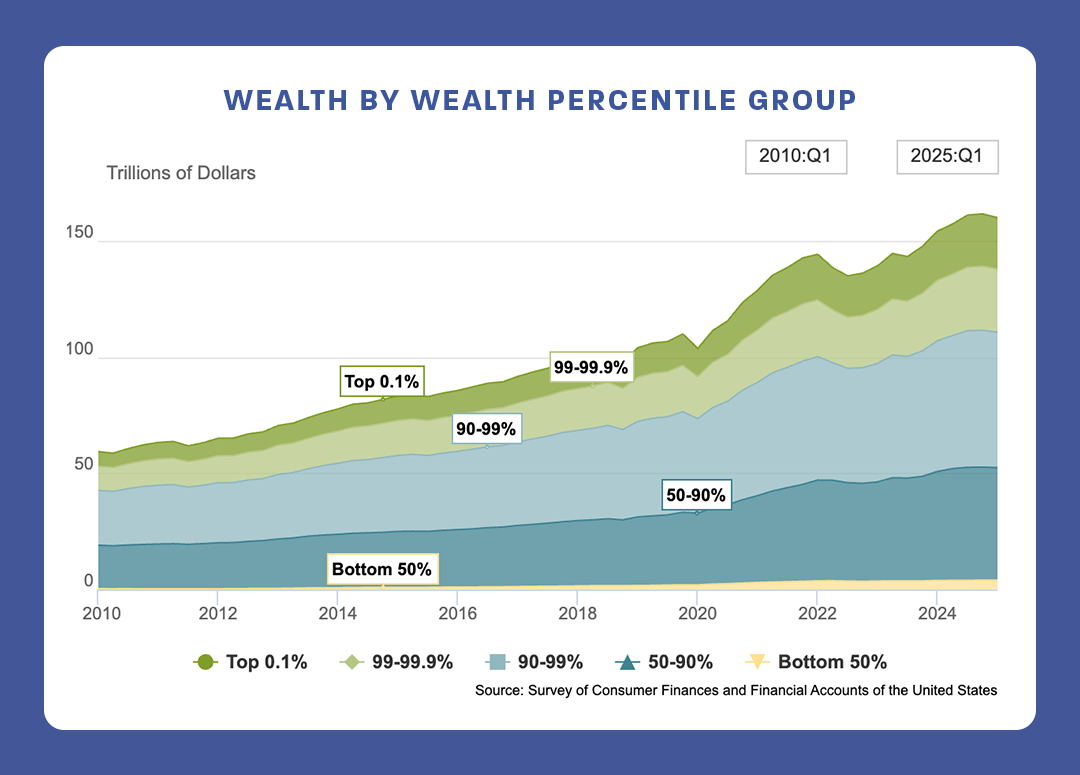

Looking closely at the wealth data from the Federal Reserve (chart below), we see the top 50% gained about $9.7 trillion in the last year of data, from 2024 Q2- 2025 Q2, while the bottom 50% gained just $0.25 trillion. Drilling down, the 50-90% group’s wealth grew $2.01 trillion, and the 90-99% group grew $3.6 trillion during that year. The top 99-99.9% grew $2.16 trillion, and the top 0.1% grew $1.93 trillion. As fundraisers, seeing the rates of increasing wealth among the top tiers indicates who is able to give. And with all the talk of grocery prices, it makes sense that donors at the lower end of the wealth spectrum would tighten their wallets when it comes to giving, which is what we are seeing play out in the FEP benchmarks.

But knowing is only half the battle.

Raising more from less has become a theme – and the deeper we look at the data, the more becomes clear why. So bottom line, what does all of this mean for fundraising? Simply put, lower-dollar fundraising programs are experiencing more challenges to acquire, reinstate, and retain donors.

As the old saying goes, you cannot control the wind, but you can adjust the sails. So as fundraisers, what are our options? To maintain or grow our bottom-line numbers, we need the people who can give to increase their frequency of giving or increase the amount they give.

Here are five things you can explore within your own program to help make this happen:

- Revisit the donor flow and trace their experience. For example, are all the best people being captured in the renewal series? Are new, renewed, and any other donors being placed on a separate path for resolicitation, or will they be ignored? At the same time, are the different contact channels operating cohesively to avoid donor confusion or unnecessary spend?

- Explore opportunities for more passive appeals, such as adding automations for second gifts, ensuring acknowledgments are refreshed and running optimally, or considering inexpensive follow-up mailings to major campaigns.

- Continue focusing on strengthening your Sustainer programs with invites and upgrades. Recurring giving allows those who cannot donate at a higher amount to give more frequent gifts, providing a strong stream of revenue for the program to lean on.

- Recruit donors who have shown to give at a higher level. Lean in and test things like overlays in acquisition or MissionWired’s modeled targeting tool for high-level donors, The Mid-Level Co-Op, to replenish your file.

- Test new ask amounts. Walking donors up the ladder is great, and this goes beyond shepherding the right supporters into a mid-level giving program. Even lower-dollar donors can sometimes increase their gifts with smaller upgrades of nominal amounts, like $2 to $5. At lower giving levels, these upgrades can make a difference when you consider the size of this audience. Tactics like tweaking the ask builds or including a call out to help offset processing fees can help.

![]()

As we gear up for a busy year-end in a challenging fundraising season, there are still plenty of tactics you can apply to your Giving Tuesday and end-of-year campaigns to move the needle and maximize revenue with the audiences that are able to give. Review our 2025 EOY Checklist for a range of small details that can help drive impact. And take a broad look at the story you’re telling across your integrated campaign in Five Essential Elements of a Standout EOY Campaign. If you’d like to chat more with our team about how your unique organization can achieve growth in this challenging environment, share your info here.